What happens when you overprice your home?

by Talyssa D'avila

What happens when you overprice your home? When the real estate market favors sellers, it’s almost like there’s a feeding frenzy among buyers trying to secure listings that seem to get snapped up within hours of being put on the market. Such demand drives the prices of homes up rapidly, which only feeds into the perception that the good times will last forever. Unfortunately, trees don’t grow to the sky and there will always be a top of the market. What this means is...

Read MoreWhy Getting Pre-Approved Is Your First Step to Homeownership Success

by Talyssa D'avila

Why Getting Pre-Approved Is Your First Step to Homeownership Success Turning Dreams into Reality Without the Nightmares Buying a home is a dream many share, but the journey from aspiration to acquisition can be fraught with challenges if you're unprepared. In today’s dynamic real estate market, getting your offer accepted isn't just about finding the right property—it's about presenting yourself as the ideal buyer. Let's navigate this journey together, ensuring...

Read MoreWhy You Should Have A Home Inspection Before You List

by Talyssa D'avila

Why You Should Have A Home Inspection Before You List One of the largest home sale killers is the home inspection. Nearly one-third of all terminated real estate contracts fall apart because of the inspection results. Inspections also ranked as the number three cause of delayed settlements, accounting for 13 percent. For some reason - and I’ll never get it - a home inspection that comes back with anything less than a perfect report strikes fear into the hearts of buyer agents and...

Read MoreHow much you should put down to purchase your new home?

by Talyssa D'avila

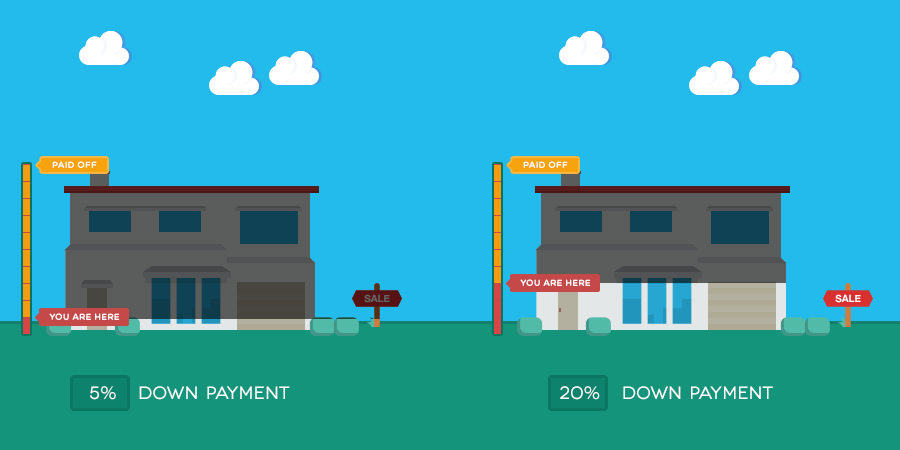

How much should you put down to purchase your new home? Historically, home buyers seek to put down 20% when they purchase a home. However, according to a recent survey by The National Association of Realtors (NAR), the actual national average is much closer to 10%. When it comes to first-time homebuyers, the average down payment is at 4% as per the same survey. While down payment requirements vary based on the lender you choose to work with, the amount required will usually depend...

Read MoreWhy You Should Get a Home Warranty When You List Your Home

by Talyssa D'avila

Why You Should Get a Home Warranty When You List Your Home Home warranties aren’t just for buyers anymore. In the past, buyers have asked sellers to pay for a home warranty to give them a year of protection after it sells on roughly 16 major systems in the house including things like the electrical system, appliances, hot water heater, furnace, etc. Overall, it makes sense because the first time claim on a home warranty for most buyers runs around $1,500 to 1,600 plus a deductible...

Read MoreHow to Qualify for a No Money Down Home Purchase

by Talyssa D'avila

How to Qualify for a No Money Down Home Purchase Unlocking the Door to Homeownership In today's ever-evolving real estate market, the dream of owning a home might feel just out of reach—especially when faced with the challenge of saving for a down payment. But here's some uplifting news: even in today’s climate, there are exceptional loan programs that can help you purchase a home with little to no money down. Let's explore the best options available and guide you...

Read MoreHow much money will go into your pocket after your home is sold?

by Talyssa D'avila

How much money will go into your pocket after your home is sold? It’s not what you make, it’s what you keep that matters. This holds especially true when it comes to the sale of your home. The sales price you see at the top of the closing paperwork is rarely, if ever, the amount of money that ends up in your pocket as the seller. There are often a variety of costs and fees associated with getting a home sold, so it’s important that you understand exactly what you’re...

Read MoreHow much should you offer on the home you fell in love with?

by Talyssa D'avila

How Much Should You Offer on the Home You Fell in Love With? Navigating the Home Buying Process in Today's Market You've spent months searching, and now you've found the home of your dreams. The next crucial step is determining how much to offer to make that dream a reality. In today's dynamic real estate market, crafting a compelling offer requires strategy, research, and a touch of finesse. Here's how to navigate this important phase of your home buying journey. Understanding...

Read MoreHow to Buy a Home and Keep the Furniture

by Talyssa D'avila

How to Buy a Home and Keep the FurnitureEmbracing Your Dream Home—Furniture Included In the ever-evolving real estate landscape, finding a home that resonates with your vision is a thrilling experience. But what if the dining room table, the cozy sofa, or that exquisite bookshelf captures your heart just as much as the house itself? Good news—you can make them part of your new home. Let's delve into how you can negotiate to include furniture in your home purchase. Identify...

Read MoreHow to Find Bank Foreclosures and Distressed Sales in Today’s Market

by Talyssa D'avila

How to Find Bank Foreclosures and Distressed Sales in Today’s Market Looking for a great deal on real estate? Bank foreclosures and distressed properties can offer incredible opportunities—but you need to know where to look. This guide breaks down how to find distressed properties, evaluate their potential, and make smart investments, all tailored for today’s housing market. What Are Bank Foreclosures and Distressed Properties? Bank foreclosures and distressed properties...

Read More